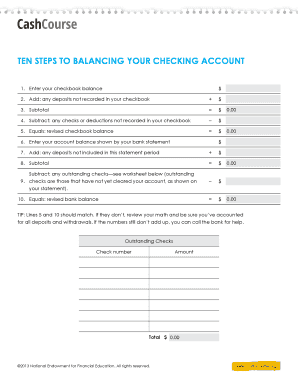

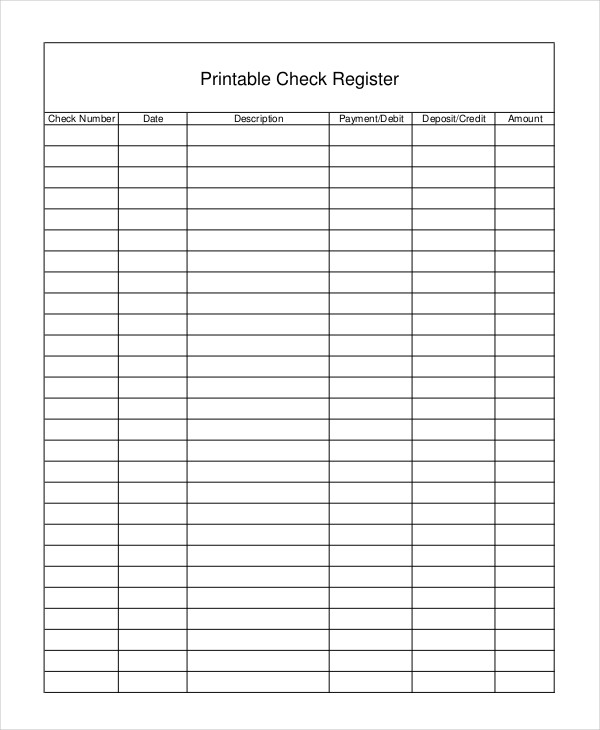

Ensure these transactions match, penny for penny. Go through each transaction listed on your bank statement one by one. When you receive your monthly bank statements, either online or by mail, you’ll need to review them against your personal records. Step Two: Review Your Monthly Bank Statements Don’t forget to add in any banking or ATM fees. For deposits, write down the amount deposited, the source of the deposit, and the date it was deposited. For deductions, write down the date the money was paid, where the money went, and the total that was deducted. To balance your checkbook, you’ll need to have a detailed record of all the transactions that occurred in the account. Your checkbook should come with a ledger for recording transactions.

This way, you’ll always know the current balance in your account and the money you have available. You’ll need to learn the steps to balancing your checkbook so you can keep track of the withdrawals and deposits in your account.

#BALANCE CHECKBOOK HOW TO#

Step-By-Step Instructions on How to Balance a Checkbook 2 The Benefits of Balancing Your Checkbook.1.5 Step Five: Draw a Line Where You Finished Balancing.1.3 Step Three: Make Sure Your Personal Record and Bank Statements Match.

0 kommentar(er)

0 kommentar(er)